Free Online Filing Options for Your Taxes

Once a year like clockwork, the whole of society comes face to face with the financial review of the prior year’s income and activity in the required annual tax reporting. This presents a lot of challenges to many in preparation of the documents that will be filed, as well as making sure that tax law changes are reflected in how you are presenting your data to the Federal and state authorities receiving the forms. With all the impending financial and time costs invested into this yearly ritual, non-cost options can provide a needed relief.

If you meet the right requirements, you can use on of several software solutions to file your taxes that participate in the IRS non-cost alliance. Each option provides a different set of qualifications and benefits, so it is a good idea to consider which is best for your situation.

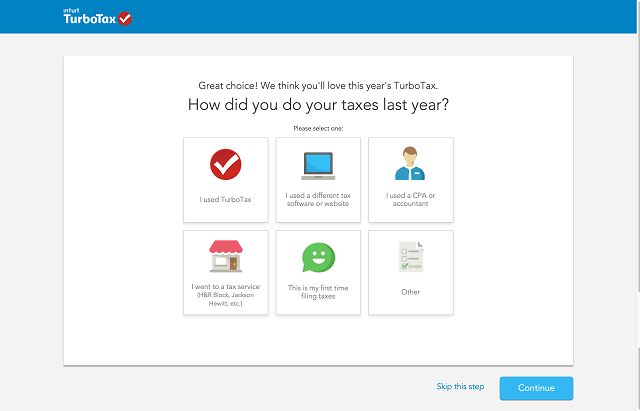

TurboTax

One of the oldest and best known tax preparation solutions is TurboTax. Their non-cost filing option is known as Absolute Zero, and it has some important positives and negatives for use. You can import your W2 into the form, make use of live chat, file your first state return without a fee, and offers you a guarantee of the best/fastest refund. However, it is primarily for simple returns and does not offer the option of filing Schedule C, D, E, or F in their option. It also does not let you itemize deductions, and customer service is limited to basic technical guidance.

TaxSlayer

Another popular choice for non-cost tax reporting is the TaxSlayer plan. Like TurboTax, you can file your Federal and state returns with them. However, their option is limited only to those filing Form 1040EZ. More complex forms will need higher cost options, as well as those that desire customer support or audit assistance.

Esmart Tax Free Plan

If you have driven down the street in many of our nation’s cities, you have probably seen signs for one of the nation’s largest tax preparation services, Liberty Tax. Their esmart plan provides online chat support, audit assistance, and the ability to import not only W2s but prior year tax returns from not only themselves but other major tax filing software sources. If you need to file for the Earned Income Tax Credit or Affordable Care Act health subsidies, this choice is still able to handle your more complicated situation. However, their extended support does not include situations such as self employment income, itemized deductions, or capital gains / losses reporting. For that, you will need a higher cost option at Liberty.

H&R Block Online Free Edition

Like Liberty, H&R Block’s services are very well known, due to high publicity and return use of both it’s brick and mortar locations and online filers. Their non-cost option is great for those with Affordable Care Act complexity. However, they are still lacking in support for more complicated items such as self-employment income, capital gains/losses, rental income, and more. Unlike Liberty, you cannot access prior year tax returns without a fee. However, it is an informational software package that helps you see changes in your balance with explanations, real time. It also provides audit assistance support.

TaxAct Free Edition

TaxAct provides non-cost reporting for your Federal and state returns. However, there are several limitations that have to be considered, as well. Accessing prior year returns will cost you an additional fee, as well as paying your filing fees out of your tax refund. However, it places greater limits on who can qualify for its non-cost services than the general IRS program requires. To use its services, you must be one of the following:

- Younger than 56 with an AGI under 53,000

- Qualify to receive the Earned Income Tax Credit

- Active Military and AGI under 66,000

FreeTaxUSA Free Edition

The FreeTaxUSA free option provides much more flexibility in complexity than the competitors, above. You can file with it, regardless of your tax situation. However, it does have a few notable limitations, such as the absence of audit support, prior year importing limitations, and state returns are only non cost in 20 states. If you live in one of the other states, it will cost $12.95 to file your state return.

www.IRS.gov

Finally, if you are knowledgeable in tax law and preparation and feel comfortable in reporting your taxes, you can use the IRS’s own online option that is makes available at www.irs.gov with PDF’s that you can fill out and submit in their online program. It doesn’t provide real time entry information or audit guidance. However, those with the training and experience to do the entries themselves will find everything needed in this service.

Conclusion

Online reporting of your taxes is not an easy path to navigate. However, the technological options that are available for taxpayers is always expanding, and non-cost options are available through many reputable vendors to report your financial condition, fast and easily.