Maximizing the Benefits of Retirement Calculators

If you spend at least a few minutes dreaming about retiring throughout your typical workday, you are not alone. Leaving behind the rat race and living life on your own terms is a top goal, but you will not achieve this goal without proper planning and considerable effort. In order to live comfortably without the regular financial support of a paycheck to infuse your bank account with funds, you will need access to other funds to pay for your regular expenses. A common question that people have relates to how much money they need to retire comfortably. Many people also want to know how they can estimate the right amount of money to save and invest in order to reach retirement goals. You could work with a financial planner, but you also can complete complex calculations on your own thanks to numerous online calculators.

How to Plan for the Future

When you plan for your non-working years, you must first determine how much money you will need to live on in the future. Creating a budget for your various expenses a decade or two down the road can be challenging. This is based on your current lifestyle, where you plan to live in retirement, how you plan to spend your days and what age you want to leave the workforce. Numerous calculators are available to help you estimate your financial needs in retirement. Keep in mind that there are several different ways to fund your lifestyle after you leave the workforce.

Some people will draw money from a retirement account, and this account balance will slowly decrease over time. The possibility of running out of cash must be considered with this scenario. Others will live off of interest, dividends, rental property income or other passive income streams. With this approach, your initial nest egg may not decline in value. However, each situation is unique. Through the use of different online models, you can make an informed decision about the best approach for you to take.

Taking Multiple Moving Factors into Consideration

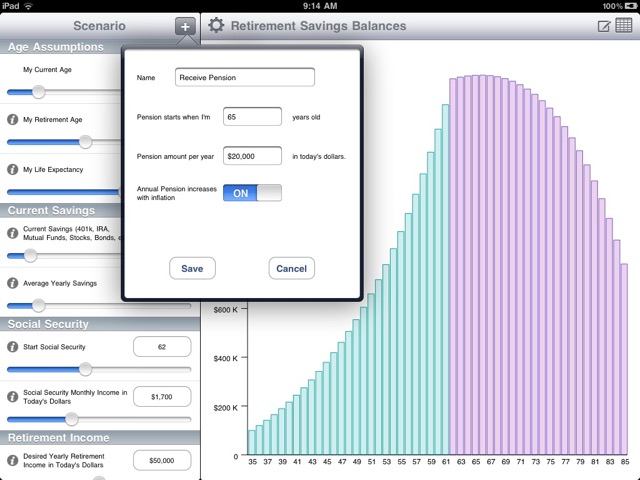

Some online calculators are rather basic, but others may ask you to complete a dozen fields or more in order to generate results for you. Many of these factors fluctuate, such as inflation, the rate of return on your investments and even your living expenses. Consider, for example, that medical expenses typically increase substantially for retirees as they age. A basic online model may help you to set general goals and to develop a rough plan. This may be suitable for planning efforts when you are many years away from retiring. However, as you get closer to retiring, it makes sense to use a more detailed online model that takes into account all relevant factors. For example, it may ask you to set your monthly needs when you initially retire and what percentage you expect your expenses to increase annually. You may even use a calculator periodically after you retire to ensure that you are still on track.

Why Using Multiple Calculators Makes Sense

When you begin looking at different models available online through different websites, you will notice that they take into account different factors. If you plug in a few similar scenarios into various models, you may also notice that the results are slightly different. This is because some models hold different factors constant, and they may use a different constant than other models. Other models may give you the ability to adjust that factor rather than holding it constant. Some people may find one calculator that generates more desirable results, and they may bookmark the page to use that calculator for future needs. However, because so many different factors adjust before you retire as well as afterward, it makes sense to look at various scenarios. When your planning efforts work well under various models, you may feel more confident with the plan that you have created.

The thought of running out of money after you retire can be frightening. This may force you to re-enter the workforce, to live a much less desirable lifestyle than you were hoping for or even to move in with adult children later in life. These are scenarios that most people want to avoid, but they are also scenarios that become a reality for many retirees. The best way to work toward a desirable outcome is to plan properly for the future. Thanks to the availability of retirement calculators, you can create a thoughtful plan and can regularly review your status. A calculator may also help you to determine when you are ready to take the leap and leave the workforce behind. If you have not already used these online planning models, now is a great time to put several to use and to update your plans to leave the workforce.