What is The Difference between the PPO and HMO Plan?

Medical covers are one of the most important necessities for any individual. It is essential to keep in mind that there are so many options available in the market. The health insurance plans are confusing if you do not know the difference. Understanding the difference provides you with valuable information to make wise decisions. Make sure you choose a plan that can meet your budgetary and healthcare needs.

What is a HMO plan?

The abbreviation stands for health maintenance organization. The plan consists of a network of healthcare providers. The system agreed to supply the members of the program with medical services. The system being a network provides members with broader medical coverage. One primary characteristic of HMO is that it charges low prices when compared to other plans. The reduced costs arise due to negotiations were undertaken with the relevant insurance companies.

What are the types of HMOs?

- Staff Model Practice Association

It focuses on a group of individuals such as a family. The physician in charge receives a standard fee despite the number of people he is treating in the family. - Individual Practice Association

The plan deals with specific individuals. The physician receives fees based on the single individual whether you visit or not. - Open-ended Practice Association

In this option, members enjoy the benefits of the prepaid care plan. Whenever you receive care from an outside specialist, you receive the co-payment plan cover.

How does it Work?

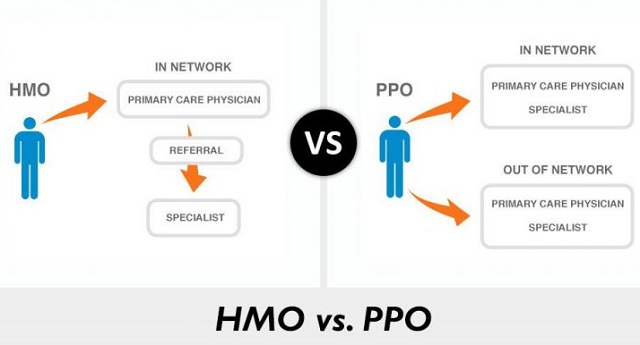

Once you become a member, the network provides you with a primary care physician. The primary care physicians deal with your health concerns. Whenever you have an issue that needs a specialist, the PCP facilitates the process for you. He or she can provide you with a referral letter. It’s important to note that whenever you see a specialist outside the network, you are liable for the medical bill.

What are the Advantages?

The option provides you with a one-stop shopping experience. It is very convenient for people who would like to receive all medical services from one point. The members pay a low monthly premium payment to the scheme. The amount for the installments is fixed and thus allows one for budgeting beforehand. Having your PCP will enable you to receive individualized care. In the cases where you need a referral, he can recommend one to you. It, therefore, saves you the time you would take researching. You do not need to fill out insurance claims when seeing outside specialists. What you need to carry is your card for identification.

What are the Disadvantages?

The centralized nature of the system is sometimes disadvantageous as you cannot receive care anywhere else. Some places will not have access to the cover due to the distance factor that makes it too rigid. Sometimes it is hard for you to get appointments on time and may thus delay access to care. Also, when you visit a specialist outside the network, you are liable for your bills.

What is a PPO?

Unlike the HMO, the preferred provider organization is complex. It consists of preferred care facilities and physicians. The members thus have access to all the care facilities and physicians from the recommended list. It has no PCP, and so there is direct access to a specialist without referrals.

How Does PPO Work?

After you gain membership, you have access to the services in the extensive network of care providers. You get to receive the most benefits out of the plan by visiting the places that accept the program. There are high monthly premium payments that you have to pay for the medical services. In times that you visit a specialist from outside the network, you get the co-payment plan cover. The cover takes care of a percentage of the total charges, and you pay the rest.

What are the Advantages of PPO?

The decentralized nature of the PPO offers flexibility to the members. You can walk to any care facility and get assistance as long it is within the network. The broad scope of choice allows you to visit care centers where you prefer. There are also no referrals as it is in the former plan. You have direct access to any specialist with a co-payment benefit.

What Are The Disadvantages?

In the long run, the plan is costly. Apart from paying the high monthly premiums, you also pay for other costs. The additional costs come about when you visit a specialist outside the network. You can get coverage that does not offer as many benefits as others. Choose a plan that provides the best benefits for you. You also have to file insurance claims every time you visit a specialist.

Based on your medical needs and budget, you will be able to make the wise decision.